RESEARCH INSIGHTS

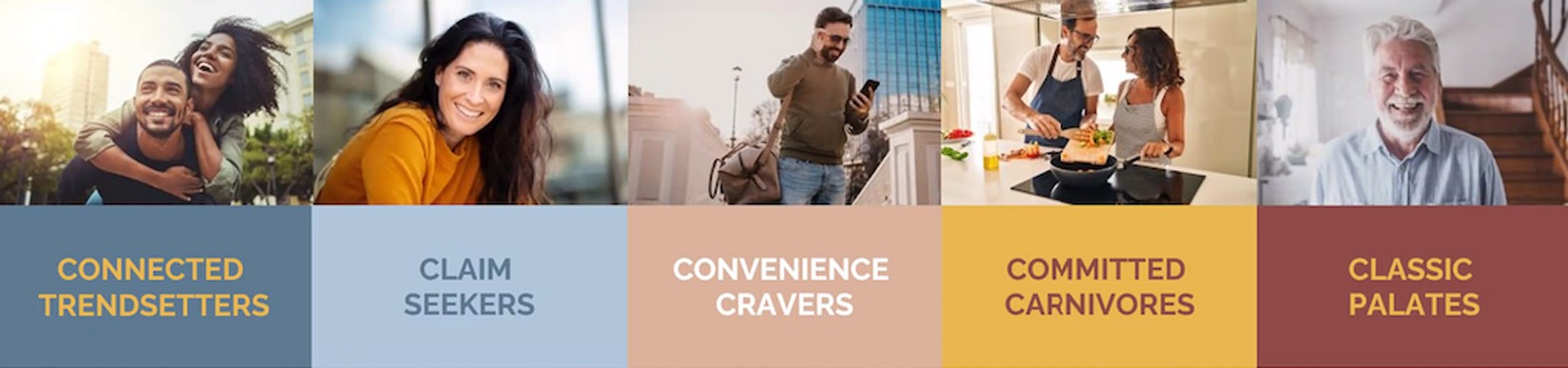

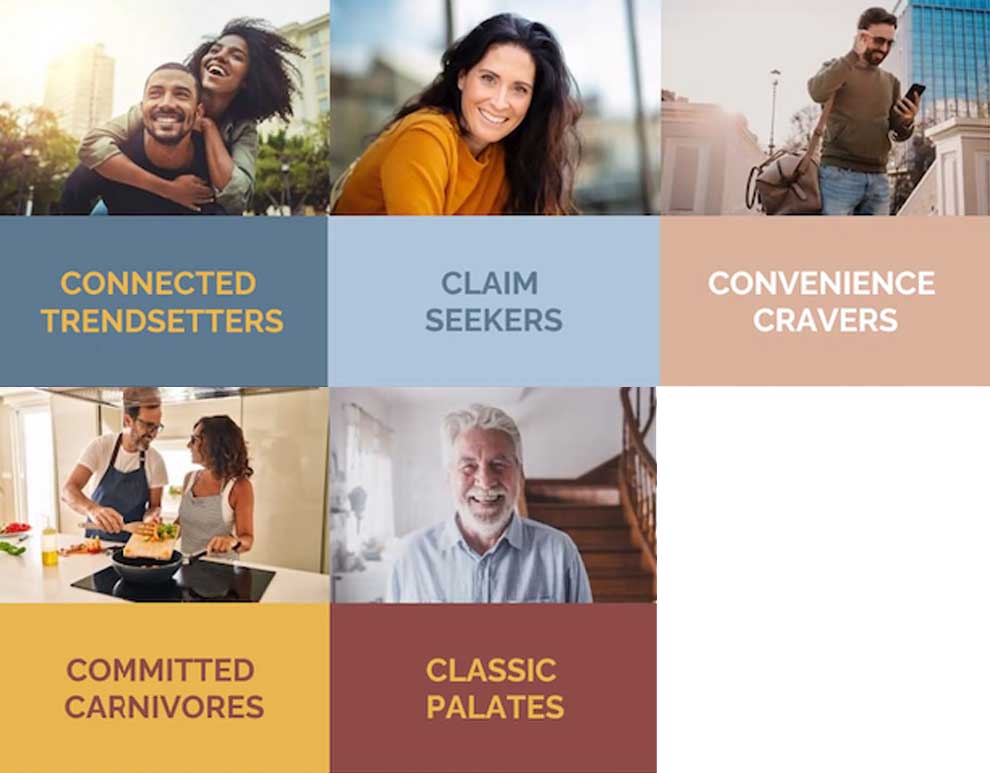

Midan conducted a comprehensive survey encompassing a representative sample of 1,300 U.S. adult consumers who purchased and consumed meat or poultry in the last three months. Segmented into five distinctive categories, the findings present a rich tableau of today’s varied meat consumer landscape.

In the face of the unprecedented challenges brought by the pandemic and the subsequent economic uncertainty, the consumer market has witnessed a substantial shift in habits and behaviours. In a recent Midan Marketing Consumer Segmentation Report, produced as a webinar for the North American Meat Institute, the importance of grasping the evolution of the modern meat consumer more towards tailoring products and messaging that resonate with their preferences was highlighted.

Let us explore each segment in detail to understand their unique purchasing characteristics better:

- Connected Trendsetters (14%) Distinguished by their profound connection to the internet, the Connected Trendsetters showcase a penchant for adventure and a keen interest in experimenting with new culinary options, thought of sometimes as a way to travel. Most (75%) rely on online influencers for fresh inspiration regarding new products. As the youngest segment, with an average age of 37, they actively engage with their meat purchases, fostering a dynamic and vibrant meat market. They also use reviews and recommendations with each other to locate brands they like to support. They are the most likely segment to purchase meat online.

- Claim Seekers (24%) This segment is guided by a sense of responsibility and a tendency toward scrutiny, keen on procuring meat products boasting attributes such as organic, grass-fed, or humanely raised. They prioritize health and environmental consciousness, often willing to invest more in products that align with their values. They think of their own health, the happiness of the animals, and how well the planet is being taken care of. They primarily consume chicken and consider switching to plant-based alternatives from pork and beef. These consumers meticulously scrutinize packaging and labels, choosing products from trusted national brands. They are willing to experiment if the product meets their expectations and values.

- Convenience Cravers (17%) Convenience Cravers are characterized by their time-sensitive approach towards meat consumption. Often juggling a busy schedule, they prefer quick, hassle-free meals without compromising the quality of the meat. 40% of this segment resort to online shopping to save time and are attracted to value-added meat products, with mobile apps being their go-to source for recipes and promotional updates. Making life a little easier is the core driver, and they aren’t interested in cooking much and certainly looking for reduced preparation to get food on the table. This cohort skews young and male; Generation Z can also be found in this group. They are very price-sensitive.

- Committed Carnivores (23%) As staunch meat fans, 96% of Committed Carnivores derive pleasure from family meals enriched with meat, often prepared from scratch. They skew older for the most part. Unswayed by label claims, their deep-seated love for meat drives their preference, primarily sourcing their supplies from traditional retailers. Although they enter the store with a firm plan, attractive deals and discounts can alter their purchasing decisions. They are the most likely segment to shop for new brands and are average social media users.

- Classic Palates (22%) The Classic Palates hold onto their habitual preferences, largely sticking to familiar meat products in their meals. However, there is a growing sentiment that meat has become overly expensive, which steers them towards purchasing meat only during promotions or sales. Influencing this segment poses a significant challenge, with a large proportion (44%) resistant to changing their minds once in-store. They are rarely online socially.

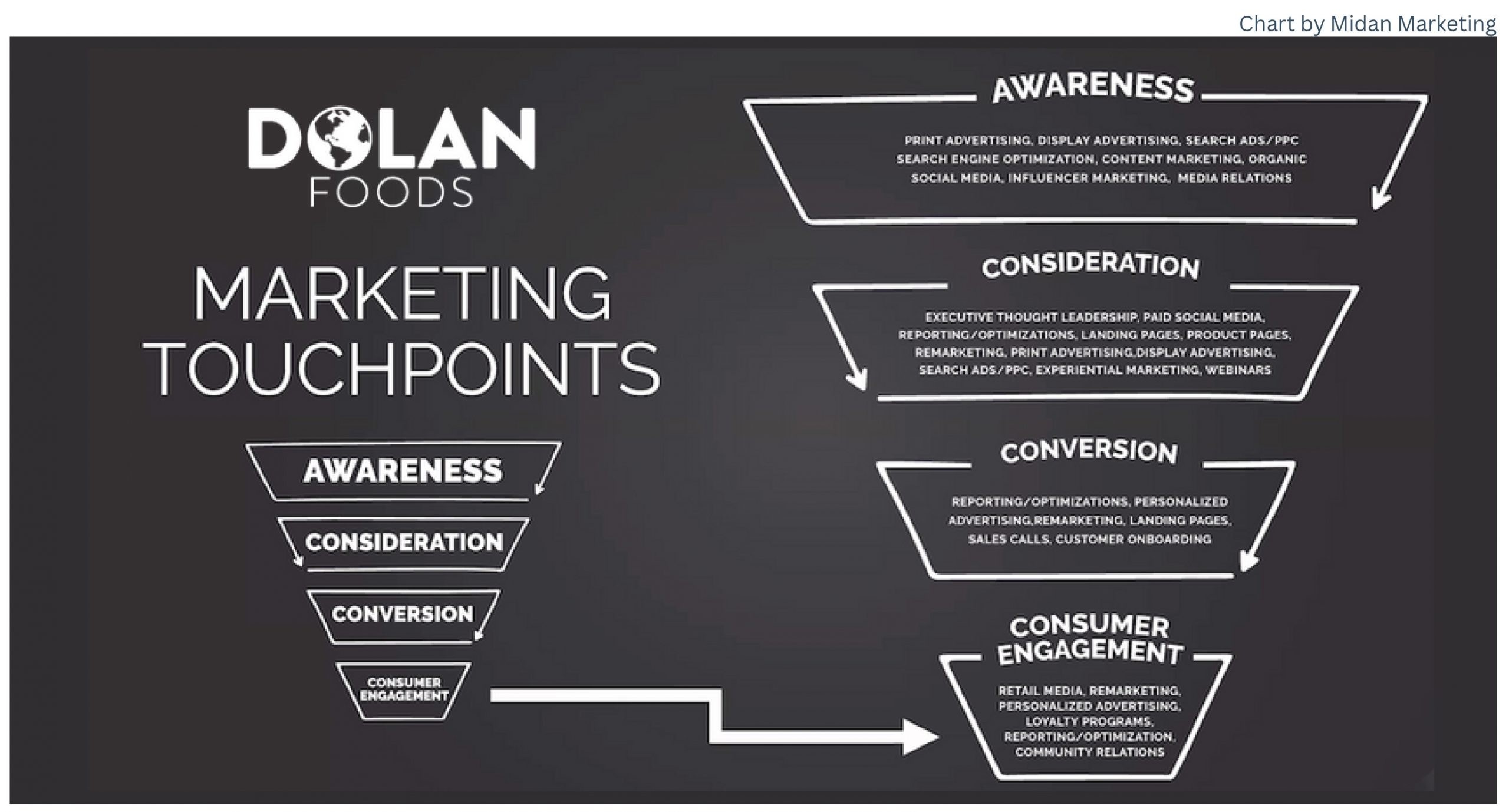

During the webinar launching the Midan Report, the importance of a defined Customer Journey was discussed.

Awareness: This is where each segment would first be introduced to a brand, remembering that the five groups above discover brands in different places and at individual times. In some cases, online influencers and organic social posts are that entry point, but other times, it is traditional media or Google searches.

Consideration: Now that the segment audience knows the brand, they will likely want to learn more and compare. They want to know how the product will meet their needs and sometimes values. This is where deep brand knowledge and documentation will be essential. Consistency in message, tone and voice are all critical. Websites become the marketing watering holes that move the customer to purchase—thought leadership content, paid social, experiential marketing and landing pages on the website are all tools to convert.

Conversion: This is the point of purchase and often needs support in personalized messaging and remarketing to drive loyalty and subsequent purchases. Sales calls and customer onboarding that lead to collecting data within a CRM (Customer Resource Management) tool are imperative. Without data, there is no way to move ahead with insight or invest with outcomes in mind.

Consumer Engagement: Retention of customers is the name of the game. The more personal this engagement is, the more loyalty and advocacy one can expect. Grouping communities and formulating content specific to their needs and loyalty programs to support repeat purchasing can be important drivers of good branding.

CONCLUSION

In conclusion, the Caddle Research Webinar of August 17, 2023, illuminates the evolving consumer behaviour and inflation dynamics in the current landscape. Consumers are responding to high prices by proactively altering their spending patterns. Private-label brands, coupons, and discount offers are gaining favour, while meat purchases have been significantly curtailed due to escalating prices. The resolute awareness of shopping costs remains constant among consumers.

The webinar anticipates continuity in the prevailing trends, with a gradual transition towards indulgence over the coming years. Consumers are expected to seek quality, value-add, and pleasurable experiences.

The “Grocerant” trend will persist, impacting restaurant businesses. Moreover, the future of animal agriculture is under discussion, focusing on the ethical dimensions and potential market shifts in consumer preferences for meat.

To navigate these changes, the report suggests forging “partnerships” with Millennials and Gen Z, working collaboratively and considering their values in shaping the future of consumption. The insights from this webinar offer valuable guidance to businesses aiming to adapt and thrive in the evolving consumer landscape.